This story was delivered to Business Insider Intelligence “E-Commerce Briefing” subscribers hours before appearing on Business Insider. To be the first to know, please click here.

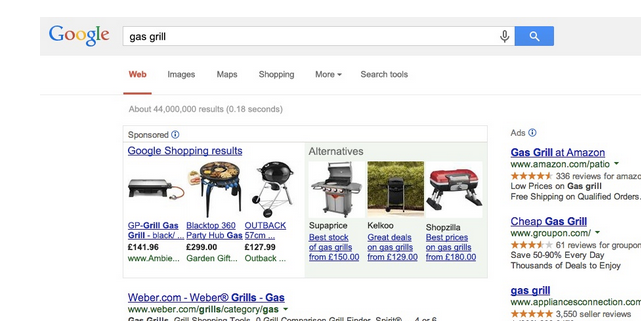

Amazon has stopped buying Google’s product listing ads (PLA) as of April 28, 2018, after competing in auctions for the ad format since late 2016, according to Merkle, a marketing agency. Retailers and brands bid for PLAs, which show up at the top of Google searches and feature product images along with information regarding price and free shipping or special offer availability.

BI Intelligence

The e-commerce titan had previously bid for PLAs in categories including home goods, furniture, and office supplies, but sources confirmed to Bloomberg that Amazon has moved away from the format, though some Amazon subsidiaries are still buying the ads.

Amazon’s exit from Google Shopping’s PLAs could be a boon to other retailers, as they won’t have to compete with it directly in search. Amazon offers a well-liked online shopping experience, which, when combined with its low prices, may have won consumers over when they saw it among Google Shopping ads. Now that it has no presence in PLAs, competing retailers might find more success in drawing sales from searches.

This is particularly important because 49% of US consumers began their online product searches on Amazon in 2017, while search engines, including Google, were the starting point for 36% of consumers, according to a survey from Survata. So search engine ads are possibly retailers’ best bet to get around Amazon’s control of product search, and now Amazon isn’t competing in that space.

The e-commerce titan may be looking to take hold of the entire product discovery process. Amazon has a strong share of product searches, but with ads like PLAs, it’s starting some of its shoppers in an outside channel, and it may prefer to capture the entire purchase process itself.

Amazon has been positioning itself to control other channels for product discovery. Amazon launched Spark, its own social media platform, last July. With

growing, and social media holding significant influence with young consumers, Amazon is looking to use Spark to win social product searches. Meanwhile, voice shopping is set to take off, and Amazon is working to entrench its Alexa products in the market, which would let it control voice search too.

It may be focusing on bolstering its own ad offerings to cut out search engines. Amazon’s ad business appears to be booming: Its “Other” segment, which primarily consists of the sale of advertising services, jumped up 132% year-over-year (YoY) to $2 billion in net sales in Q1 2018. Since Amazon holds a major share of product searches, it makes sense for brands to advertise on its marketplace. This growth could have encouraged Amazon to try to supersede Google and other search engines in the purchase process entirely by building out its own search ads.

To receive stories like this one directly to your inbox every morning, sign up for the E-Commerce Briefing newsletter. Click here to learn more about how you can gain risk-free access today.

Source: here