L Brands Declined On Bearish Sentiment, Exacerbated By Soft 2018 Profit Guidance

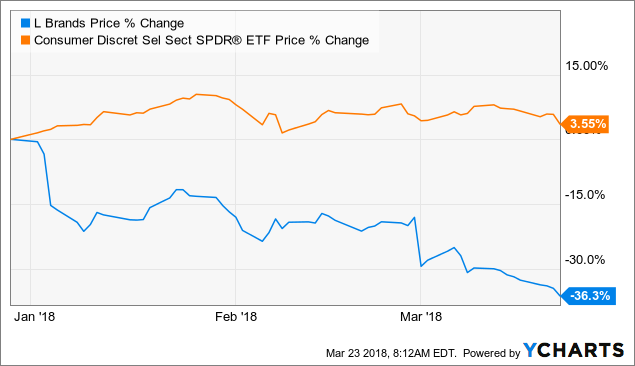

Year-to-date (“YTD”), the share price of L Brands (LB) has fallen 36.3 percent, a stark contrast to the benchmark Consumer Discretionary Select Sector SPDR ETF (XLY) which gained 3.55 percent over the same period. The ETF tracks a market cap-weighted index of consumer discretionary stocks drawn from the S&P 500. L Brands’ share price woes started before the decline in the broader market that began in the latter part of January 2018. The sell-off remains unabated this month, as the bearish sentiment was exacerbated by their soft fiscal year 2018 profit guidance, which came in almost 10 percent below consensus expectations ($2.95-$3.25 vs. $3.43).

LB data by YCharts

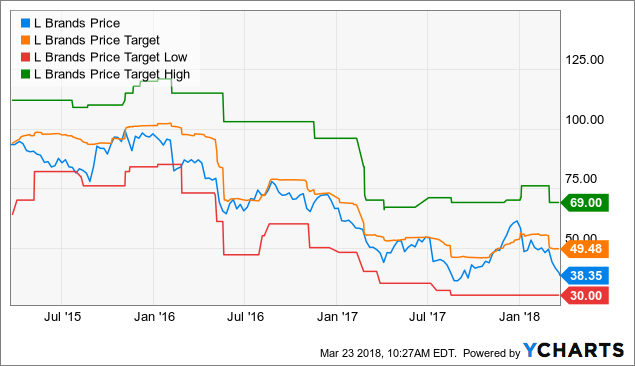

LB data by YChartsDowngrades came in swift and harsh, with Telsey Advisory Group slashing its price target on L Brands from $70 to $52, a drop of 26 percent. Bernstein also reduced its price target by around 15 percent to $59. Nevertheless, the consensus price target was only about a dollar lower than the start of the year, while the lowest and highest price targets were relatively stable over the past few months. As a result of the recent correction, L Brands is now trading more than $10 lower than the consensus price target, an indication that perhaps the market is too bearish on the stock.

LB data by YCharts

LB data by YChartsUnjustified Sell-Down In L Brands?

The 36.3 percent decline in the share price seems unjustified, considering that L Brands reported fourth-quarter earnings and revenue that exceeded consensus estimates. Unlike other retail names that are experiencing top-line weakness, L Brands admirably achieved a 7.3 percent year-on-year (y-o-y) increase ($4.82 billion vs. $4.49 billion) in its revenue. Fourth-quarter EPS on an adjusted basis also came in higher at $2.11 compared with $2.03 a year ago. Such an adverse market reaction despite the company’s concrete display of business pick-up was within my anticipation and precisely what led me to take profit last year. I had stated in L Brands: Taking Profit that it would be risky to hold out for additional gains with the uncertainty of a sustained recovery amid a challenging retail climate.

I have also written on Ulta Beauty (ULTA) in Ulta: Strong Earnings Is The Problem that after a series of consensus-beating earnings, analysts would tend to swing the other way and set tough-to-surpass estimates, leading to subsequent disappointment and the ensuing stock sell-off. This tendency is playing out in L Brands. Nevertheless, at the mid-point of the EPS guidance ($3.10), L Brands would be expecting just a 3.7 percent decline in FY2018 EPS versus FY2017. This is not factoring the opportunity for positive earnings surprises that L Brands have delivered numerous times in the past few years (there has been no miss in quarterly EPS since 2014). Otherwise, the slight EPS decline would still be a decent feat amidst the challenges facing consumer brands.

It’s Not Just A Matter of Shoppers Ditching Brick-And-Mortar Shops For E-Commerce

Unfortunately for L Brands, Amazon (AMZN) is not just impacting its business with its e-commerce platform. The encroachment of Amazon’s private label, Iris & Lilly, is the real threat to L Brands. Despite being offered at seemingly cutthroat prices as low as $7 per piece, undercutting even those sold by Hennes & Mauritz/H&M (OTCPK:HNNMY)(OTCPK:HMRZF) which generally cost over $18, lingerie of Iris & Lilly are marketed as a premium brand, rather than as a house brand of Amazon. The damage to Victoria Secret is already showing. Comparable sales fell 8 percent in 2017.

In addition, as Amazon has a rich customer database many times that possessed by L Brands, its marketing reach can net more new and repeat buyers faster and at a lower cost. In fact, customers are beating their own path to Amazon’s door. According to a survey by Survata, as many as 49 percent of U.S. consumers began their online product searches on Amazon as compared to 36 percent on search engines like Google (GOOG)(GOOGL), and just 15 percent at retailers directly. In the era of fast fashion, whoever can first detect a shift in the consumer taste would be capturing the lion’s share of that demand, potentially leaving the remaining players fighting for scraps.

But L Brands Is Getting Back To Attractive Levels

At $38.35, L Brands is trading only around $3 above the bottom established in August last year. Its Price-to-sales ratio is now only 0.88, down from the 2.5 last seen during 2015-2016. The headwinds facing it is by now well-known and the management’s strategy to overcome the challenges is showing nascent results. Total sales at L Brands increased 11.6 percent to $854 million in the month of February.

LB PS Ratio (NYSE:TTM) data by YCharts

LB PS Ratio (NYSE:TTM) data by YChartsL Brands’ Investment Merits And The Strong China Growth Potential

One of the premises of buying into L Brands as the stock fell into its depths in October was the strong cash flows that the company has been generating. In the Q3 quarterly earnings conference call, Stuart Burgdoerfer, CFO and EVP at L Brands, stated that 99 percent of their brick-and-mortar stores were cash flow positive, thanks to “high sales productivity”. This has enabled L Brands to afford an attractive 6 percent dividend yield, with the 5-year annual dividend growth rate at 12.5 percent.

Ultimately, L Brands still need to deliver on its digital strategy and it’s comforting to know they are on track with positive results to show. Its digital business has been showing double-digit growth, offsetting the slowdown in the physical stores.

Central to the investment opportunity is also the fact that L Brands has been achieving favorable results from the international markets, particularly from Europe and China. Southeast Asia is also doing well for L Brands, where Martin indicated that the company is seeing “great growth” in the region. In Q4 2017, the y-o-y increase in international revenue (retail sales from company-owned stores outside of the U.S. and Canada, royalties and wholesale sales) at $34 million (adjusted down for the one additional week in the quarter), helping to offset just over half of the $65 million decline at its U.S. and Canada stores.

More international revenue growth is anticipated given that we have yet to see the full year contribution from the newly opened stores. All seven stores in China and four out of 15 stores in U.K./Ireland were opened at various timings through 2017, with five stores in China opened only in the fourth quarter. L Brands has plans for another 10 to 11 stores to open in China in 2018.

The inaugural Victoria’s Secret show in China was completed in November last year. While there was some bad press due to the conduct of certain models, overall, L Brands was expected to benefit from the publicity and the hype generated. The Forbes article on the event has an apt title: Victoria’s Secret Fashion Show May Have Stumbled In Shanghai, But The Brand Will Still Win In China. Martin Waters, President of International Operations and Chief Executive Officer of International Operations at L Brands, Inc., revealed during the Q4 earnings conference call that Victoria’s Secret Beauty and Accessories (“VSBA”) stores have been “doing well” both in the physical stores as well as online via Alibaba’s (BABA) Tmall. The company had initially under-stocked on the smaller product sizes and the preferred red color (red is considered a lucky color for the Chinese), leading to the unfulfilled demand.

Fortunately, the management has realized their glaring mistakes and corrected the issue. They absolutely have to. Market research firm Mintel forecasted that the retail value of China’s lingerie market can be as big as 148 billion yuan ($23.2 billion) by 2020. Mintel’s regional trends director Matthew Crabbe noted ” a clear trend towards consumers trading up to higher-end brands” in reference to the Chinese market.

Investor Takeaway

L Brands is trading near the bottom established in August last year. Investors appear to have a short memory, having all but forgotten what they like about L Brands when they chased its share price up from $35 to above $60 by the end of the year. This article serves as a reminder on L Brands’ success in leveraging its strong branding power to the international markets. In addition, the lingerie giant’s digital strategy is showing good traction. Its share price has more than halved since 2016, leaving its price-to-sales ratio at a low 0.88 times. L Brands is not the fantastic turnaround story in the consumer space like Crocs (CROX) was. Nevertheless, the sell-down since the start of the year meant that L Brands is back to square one, returning to the decades-long resistance-turned-support line like it did last August when market players were unconvinced that the management could stem the consecutive declines in comparable sales. Fortunately, this price correction is providing me the opportunity to re-initiate a position in L Brands.

Stock data by Yahoo! Finance

What’s your take? Readers who make a comment will have access to the comment thread indefinitely. Hence, please freely share your thoughts, let me know if you found this article useful, or provide your feedback in the comments section.

Author’s Note: Thank you for reading. If you would like a refreshing take on stocks that you own or are interested in, try looking here. Besides US companies, I cover a number of Asian stocks as well. If you wish to be informed of my new ideas via email so that you have time to read them before the articles get locked behind a paywall 10 days from publication, please click on the “Follow” button below the title and select “Receive email alerts” when accessing on a desktop computer.

Source: here