In part 1, we covered question and answer forums, keyword research, and content topic research. Part 2 takes up six more ways to conduct customer research.

4. Social Media

Social platforms provide real-time challenges, feedback… and excitement from your current and soon-to-be customers. But sifting through the endless reel of social media feeds, shares, and viewpoints provides an overwhelming task for any marketer. Here are a few tools and tactics that may help with your customer research on social media.

Twitter Advanced Search

Twitter’s advanced search function is a great tool that many people don’t know about. (It isn’t obvious to find when you are on Twitter.) You can tailor searches based on exact phrases, hashtags, location, and timeframes. This tool will help you with your Twitter research for targeting customers and reduce information overload.

LinkedIn Groups

Try to pinpoint the top three or four LinkedIn Groups that your ideal customers engage with (the Content Marketing Academy group is my favorite). Start out by answering questions, sharing relevant articles, and interacting with group members. Once you have built up enough trust and credibility, you can start to ask questions and begin discussions.

Monitoring the groups where your customers hang out will add an extra layer of insight to your customer research, and engaging with your potential customers will help shape your profile and reputation as an industry leader.

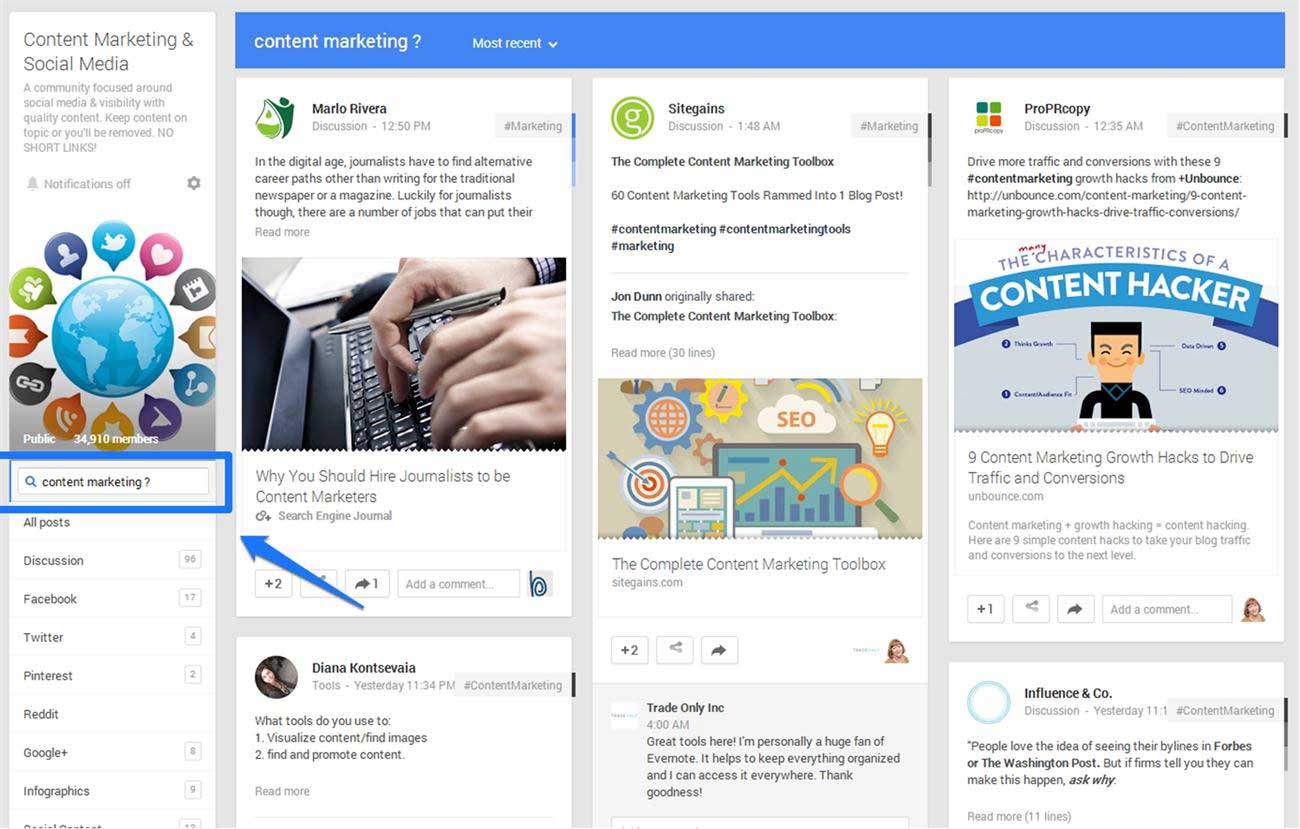

Google + Communities

Google+ Communities are similar in many ways to LinkedIn Groups: a group of highly targeted people discussing their interests and challenges regarding a specific topic. Find the communities where your customers are engaging regularly and start to get active as you would on LinkedIn.

Within G+ communities, I find the search functionality very helpful (see the image, below). By taking an already targeted group of people and narrowing down the content you are seeing even more with a keyword, you can really cut through the clutter.

Blog Comments

What blogs are your ideal customers reading? How do they engage with the authors on those blogs?

Jot down the top four or five blogs your customers comment on. Anyone who comments on a blog post will likely have set-up a profile (usually with Disqus or Google), allowing you to track that person’s information. Go beyond just tracking your customers and generate a list of themes, or common questions, that are repeated throughout these blog comments. (Hint: When you see your ideal customers asking a question, write a blog post that gives them the answer to that question).

5. Competitor Research

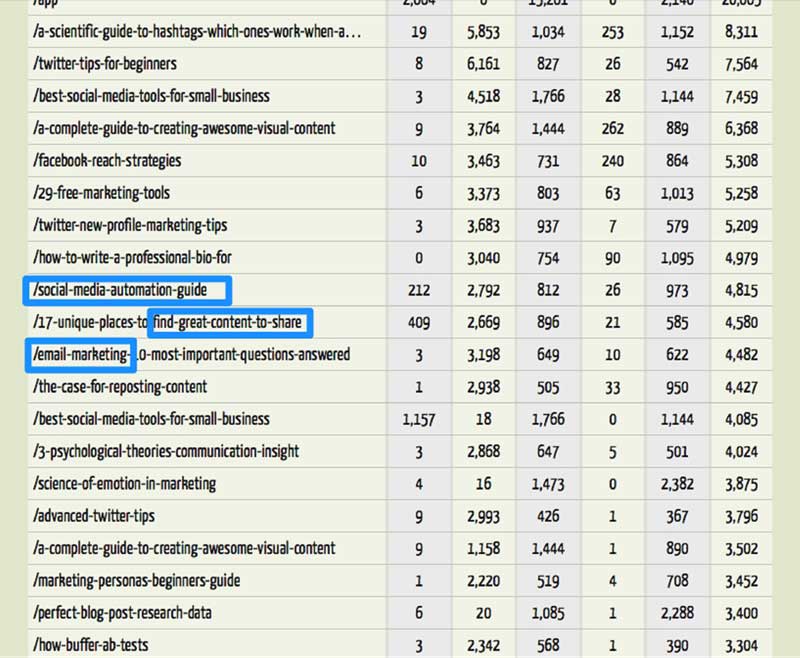

A great way to conduct customer research is to know your competitors well, even better than they know themselves. Even basic information, for example the keywords they rank in search engines for, can be invaluable for better understanding your customers. A great free online tool for analyzing your competitors is Quick Sprout.

You will see in the image that I have outlined some of the keywords that Buffer is using on its blog. If you were a competitor of Buffer (Hootsuite, for example), it would be invaluable to understand what they were talking about and what customer pain points they found important.

SEMrush is another easy-to-use tool for finding out what keywords and ad space your competitors are targeting.

6. Online Polls and Surveys

Surveying your current customers will help you know how they tick. But you must make sure you do so appropriately. The last thing you want is for your most valued customers to take a long and drawn out survey that leaves them feeling used and abused!

Here are some examples of free ways to survey your customers:

-

- Reach out to your current network via email and use Survey Monkey to conduct the survey.

-

- Ask questions on Twitter to your followers.

7. Paid Market Research

If you want to take the customer research insight to another level, you can look into a variety of paid alternatives. If, for example, you are in the early stages of growth and don’t have a big network of customers, companies such as Survata and AYMT provide access to a database of customers for you to conduct your surveys with. Or, for something a little different, you can do online one-on-one video interviews using GutCheck.

8. Online Customer Research tools

There are many customer research tools out there, but perhaps the most interesting in my eyes is the Consumer Barometer. I could go on all day about how cool this tool is, but best you just watch this short YouTube video:

9. Crowdfunding for Research

I was reading a blog post not long ago on Tim Ferriss’s “Four Hour Work Week” called “Hacking Kickstarter: How to Raise $100,000 in 10 Days.” Toward the end of the post, the entrepreneur (Mike Del Ponte) who was sharing his Kickstarter story set a light bulb off in my head! He commented on the highly engaged audience created when raising funding for a startup or a business idea.

If you’re ever unsure of a product’s viability, get people to pay in advance for it. If people commit money to the crowdfunding of a product or idea, it’s more than likely the idea has economic value. Or, if people won’t put their hard-earned money into an idea, that may give you valuable insights about where you are going wrong.

The crowdfunding “acid test” is a great way to get to know your customers and what they are looking for.

* * *

What practical methods do you use to conduct customer research?

Source: here