(This article was originally published on the site of PlanBeyond, which helps older adults sort through legal, financial and health care issues and become more informed and educated about end-of-life matters.)

America is getting older. While nearly 14 percent of the country is over 65 today, the U.S. Census Bureau estimates that number to grow to 20 percent by 2050. In fact, the Pew Research Center estimates that 10,000 Americans will turn 65 years old every day for the next 19 years.

As advocates of better late-in-life and end-of-life planning, these demographic shifts made us take pause. After all, with an aging population comes an inevitable shift in the health and well-being needs of that population. Yet the question remains: Is that population ready for it?

This question led us to explore the perceptions and understanding of long-term care in the U.S. After all, health care gets a lot of attention in the media, but the same can’t be said for long-term care.

At its core, long-term care is what people need when they are unable to take care of basic tasks that help keep them independent. Bundled into the term “activities of daily living,” these tasks can include everything from bathing and dressing to running simple errands and making a meal.

As we explored just what people think about when it comes to long-term care, we were startled by the results. Here are just some of the major stats we uncovered:

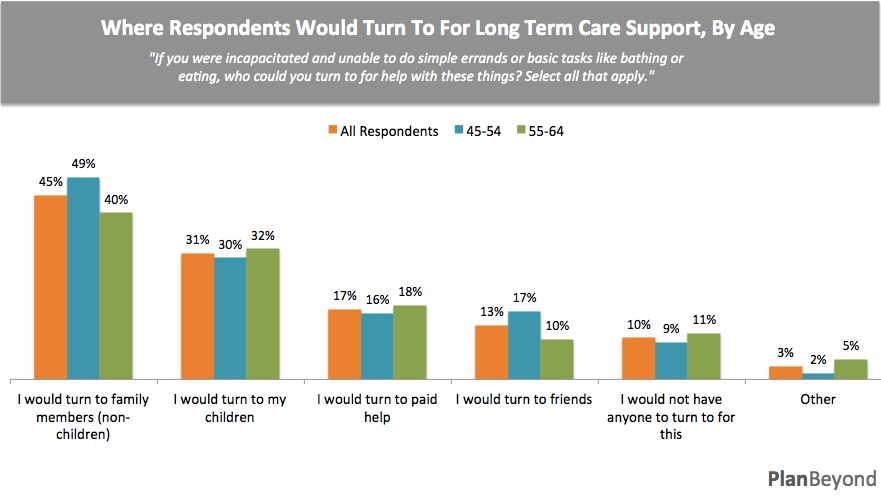

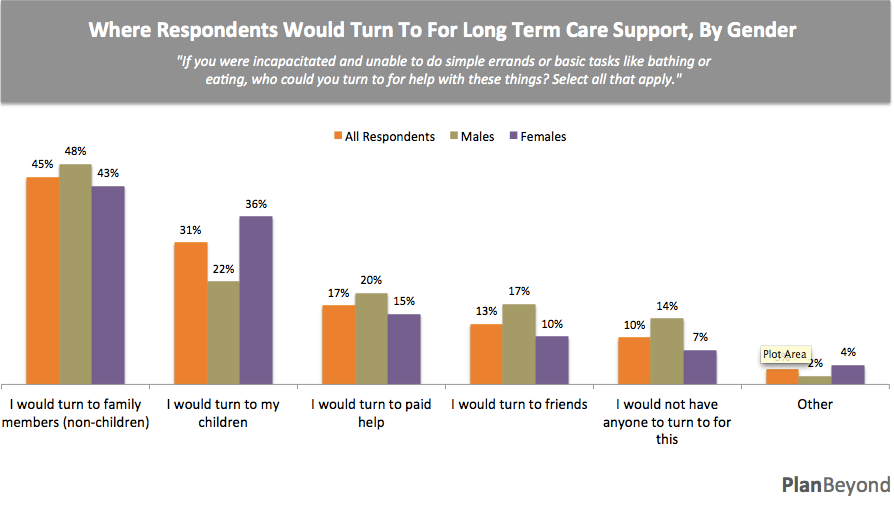

- Family members that are not kids are the most-cited group that people plan to turn to for long-term care needs.

- Women are 64 percent more likely than men to rely on their children to offer long term-care support.

- One quarter of all people plan to use Medicare to pay for long-term care — a major problem since Medicare doesn’t generally pay for long-term care.

- 67 percent of Americans underestimate their likelihood of needing long-term care.

- Women are 2 times more likely than men to estimate the correct chance of people needing long-term care.

- There is a complete misunderstanding of what long-term care insurance actually covers

- Nearly 50 percent of people cite cost as a major reason they do not have long-term care insurance.

Where to Turn to for Support

We asked respondents if they were unable to do simple errands or basic tasks like eating or bathing, who they would turn to for support? Perhaps unsurprisingly, nearly half of all respondents would turn to family members, particularly loved ones that are not their children. Respondents who were 45 to 54 years old skewed more in this direction than their 55-64 year old counterparts. Though let’s not forget that nearly one in three respondents of both age groups do expect to turn to their kids for support.

Yet look at responses by gender and you’ll find that women are 64 percent more likely than men (99 percent confidence level) to turn to their kids for support.

Why are women more likely to turn to their kids for help? While we can’t say for certain, it could be that they feel closer to their children, or perhaps they’re more comfortable having their children in a caregiver role than are men.

Non-Viable Ways to Pay for Long-Term Care

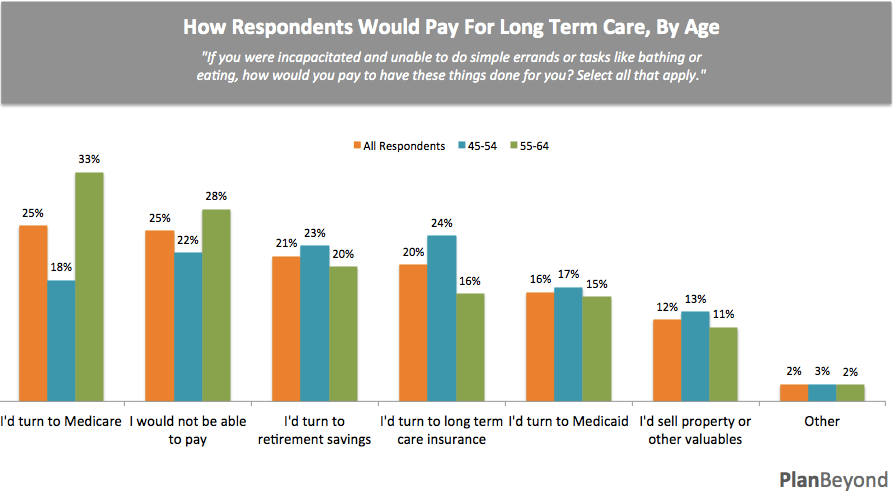

Long-term care doesn’t come cheaply, which led us to ask respondents how they would pay for long-term care. Twenty-five percent said they’d let Medicare pay for it — a major problem when you consider that in the vast majority of cases, Medicare does not pay for long-term care costs. What’s more, 33 percent of those aged 55-64 were likely to look to Medicare for support, a significantly higher percentage than the younger cohort (99 percent confidence level).

Sadly, a quarter of respondents don’t believe they’d be able to pay for long-term care support. Meanwhile, one in five would look to retirement savings or would pay for long term-care insurance.

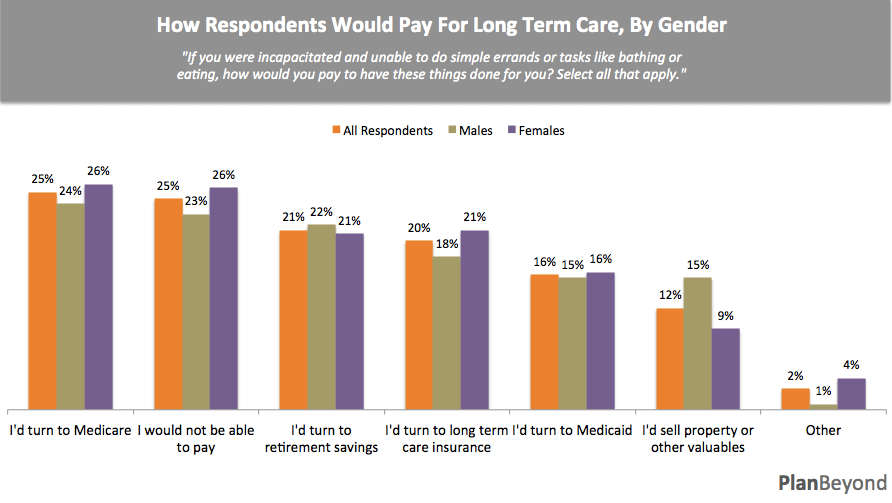

When we looked at this question by gender, it turned out that women and men are fairly consistent in their responses. And yet again, far too many are turning to a non-viable payment option like Medicare to cover their long-term care costs.

Who Really Needs Long-Term Care

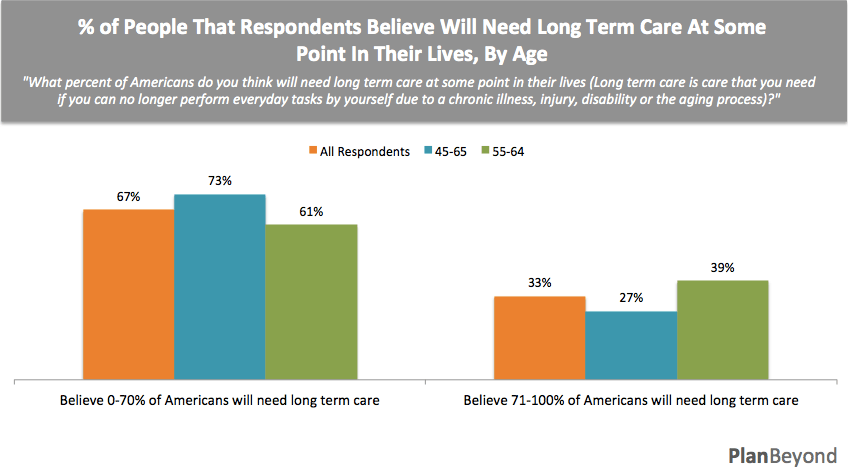

According to the U.S. government, at least 70 percent of Americans 65 years of age or older will need long-term care at some point in their lives.

Naturally, we wanted to know if Americans were aware of how likely they are to need this type of support.

The short answer is no, they do not.

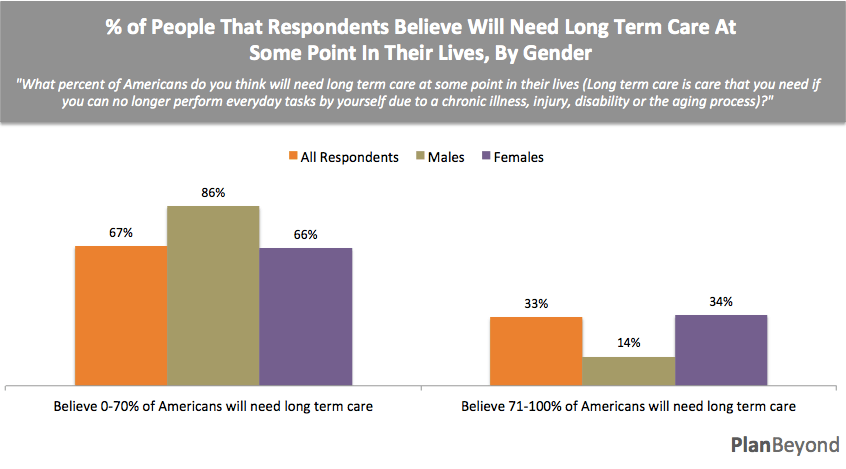

Only 33 percent of respondents guessed correctly that 71 percent or more of Americans would need long-term care. Interestingly, older respondents were 44 percent more likely (99 percent confidence level) to estimate the need for long-term care, perhaps because they, or someone they know, already needs it.

Once again, gender plays a role in the perception of needing long-term care. Thirty-four percent of women correctly guessed the percentage of people who would need long-term care. That’s more than double the percentage of men saying the same thing (99 percent confidence level). We can’t be certain exactly why this disparity exists. However, it could be that women are traditionally more likely to take on the caregiver role, and may have already provided long-term care or see themselves being more likely to offer it soon.

Misunderstanding Long-Term Care Insurance Coverage

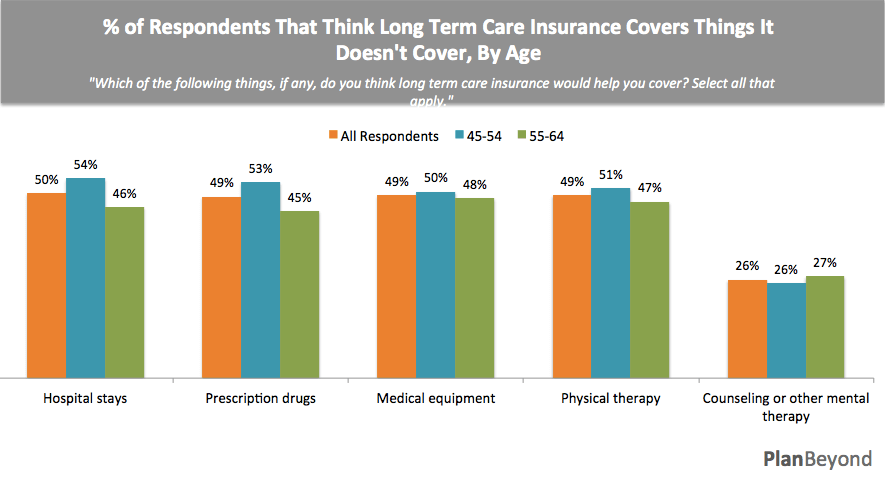

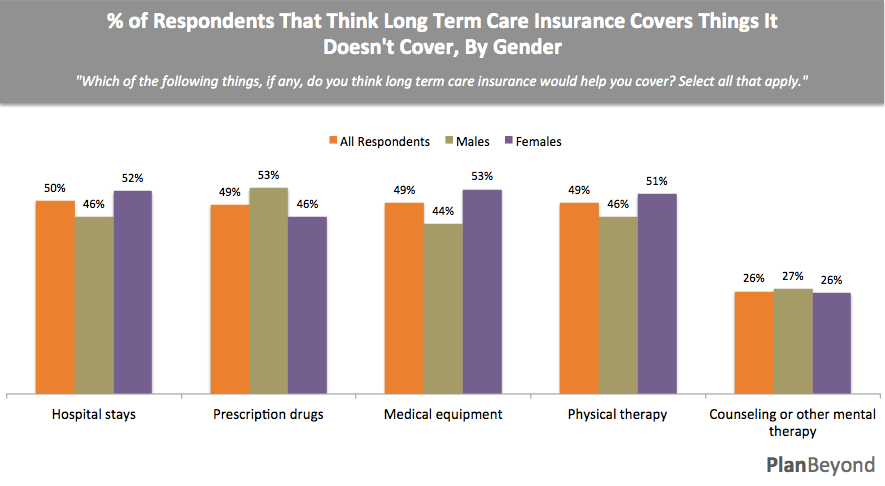

Ask those “in the know” what long-term care insurance covers and they’ll likely quote you information about activities of daily living like bathing, eating, shopping and its ability to help meet those basic needs. However, when we asked average people to guess which benefits might be covered by long-term care insurance, they fell way off the mark.

Half of all respondents believed that hospital stays, prescription drugs, medical equipment and physical therapy were covered by long-term care insurance. On the contrary, while they are generally covered by different Medicare plans, they are not covered by long-term care insurance.

This misconception exists across different age groups and different genders.

Cost And Long-Term Care Insurance

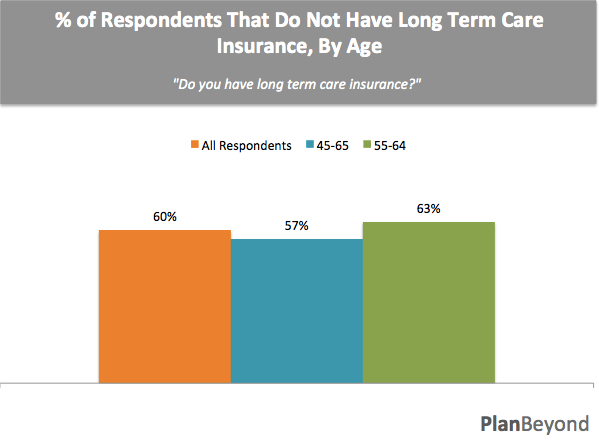

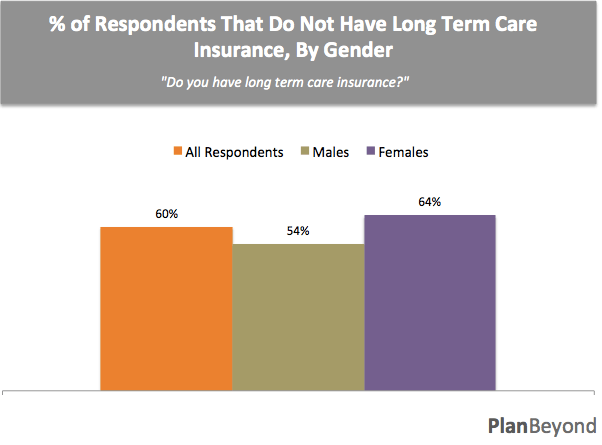

When we asked respondents if they had long-term care insurance or not, 60 percent said no, they had not invested in long-term care coverage. We noted a slight skew toward older respondents and women being less likely to have long-term care insurance.

While we can’t be sure why women are more likely than men to not invest in long-term care insurance (95 percent confidence level), it may have something to do with their reported willingness to leverage family and children as long-term care providers. With greater comfort leveraging unpaid caregivers, women may be less inclined to pay for coverage.

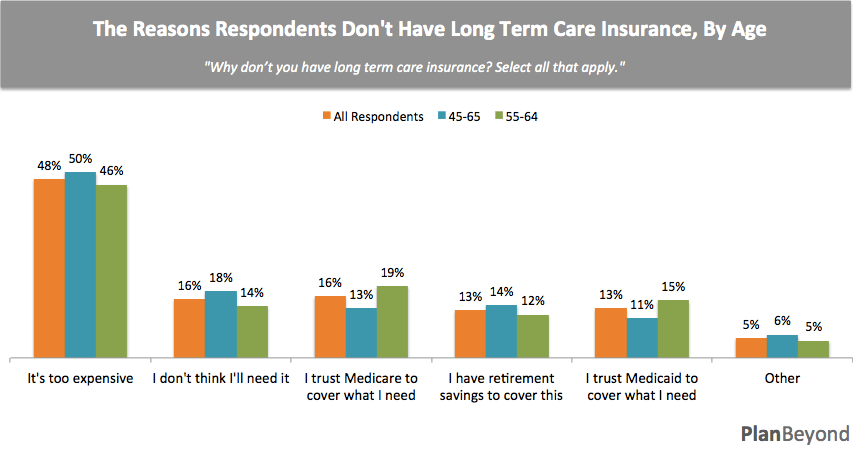

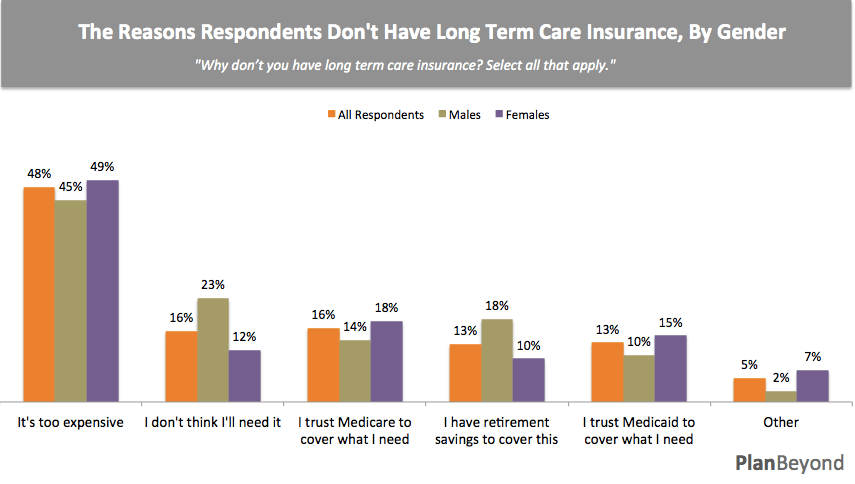

Given that long-term care insurance can mean spending $3,000 a year or more in household insurance premiums, it’s perhaps not too surprising that cost was the top reason cited as why respondents did not have long-term care insurance. Other responses, like not believing they’d need it or relying on Medicare and Medicaid, were less cited reasons for not investing in long-term care insurance.

For unknown reasons, men were significantly more likely (99 percent confidence level) to state that not believing they’d need long-term care insurance was a core reason for not investing in this product.

Conclusions

We have mixed feelings about the data uncovered in this report. On the one hand, we were heartened to see the willingness to leverage children and family members to help with basic needs as we get older. Yet this may not be a truly viable solution as children and family members as a whole spread out geographically.

In all, we see three core areas where better attention must be focused:

- Better understanding of the likelihood of needing long-term care: The majority of Americans are sorely underestimating their chances of needing long-term care, which will likely lead to exhaustion of personal and financial resources.

- Better education about what long-term care is: Advertisements are abound for the latest drug or treatments, but the same cannot be said for long-term care. Perhaps this is why so few really understand what this term entails, or how they’ll gain access to it.

- Better long-term care options: An imbalance exists between the number of people that will need long-term care and their ability to pay for it. Perhaps long-term care could become more accessible with a greater assortment of care options, or with an evolution of existing short-term care products.

The need for long-term care is not going away. Instead, it’s growing. So long as Americans fail to plan for it, let alone be knowledgeable about it, our population will face increasingly concerning health and personal trade-offs when the time comes to need long-term care.

Research Methodology

This survey was conducted by Survata, an independent research firm in San Francisco. Survata interviewed 405 online respondents between February 08, 2016 and February 11, 2016. The respondent base was split between people ages 45-54 (200 respondents) and those aged 55-64 (200 respondents). Respondents were also split by gender (162 men and 243 women). Respondents received no cash compensation for their participation.

Source: here