Upwave Study Finds Brand Advertising Still Critical Amid Success of DTC Upstarts

Brand intelligence company Upwave today released the results of a study that measured consumer perceptions of traditional brands versus their direct-to-consumer (DTC) rivals, finding that consumers place much more loyalty, trust and value in traditional brands. However, the trend narrows with younger age groups, especially among Generation Z.

The study of 1,500 U.S. consumers — which analyzed widely recognized battles between a traditional brand and its top DTC disruptor — looked at seven key brand metrics including brand connection, consideration, loyalty, price sensitivity, trust, understanding and recommendation. The grouped brands included Sealy versus Casper, Gillette versus Dollar Shave Club (DSC), Ray-Ban versus Warby Parker, H&M versus Bonobos, and Purina versus BarkBox.

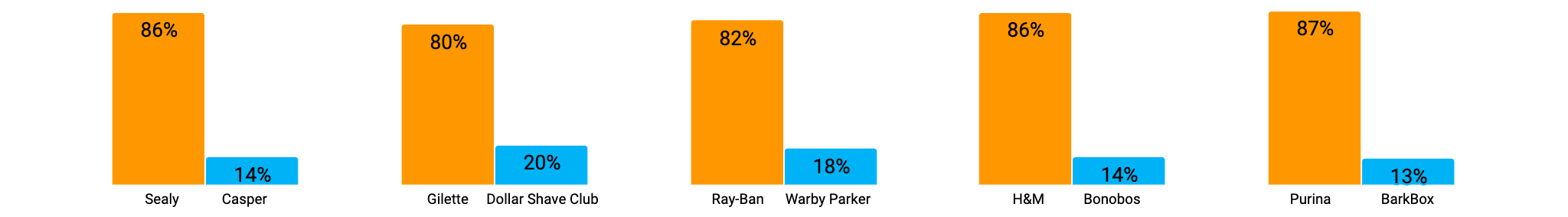

With the rise of programmatic advertising, Upwave’s study comes at a time when many marketers are debating how much brand building via digital brand advertising still matters compared to spending more on direct-response strategies. However, across every category, demographic and age, the established brand — many of which have invested heavily in brand advertising – was favored over its DTC competitor. The results included:

Which brand do you feel more personally connected to?

Sealy – 86%

Casper – 14%

Ray-Ban – 82%

Warby Parker – 18%

H&M – 86%

Bonobos – 14%

Purina – 87%

BarkBox – 13%

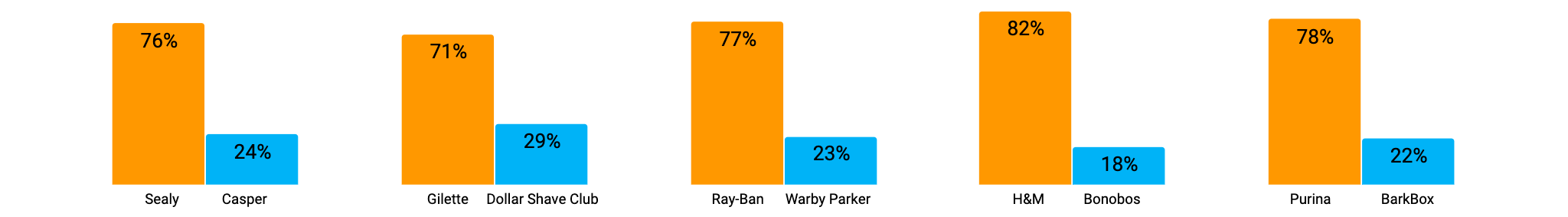

If everything about the product were exactly the same (quality, easy to buy, price, etc.), which brand would you be most likely to buy?

Sealy – 76%

Casper – 24%

Gillette – 71%

DSC – 29%

RayBan – 77%

Warby Parker – 23%

H&M – 82%

Bonobos – 18%

Purina – 78%

BarkBox – 22%

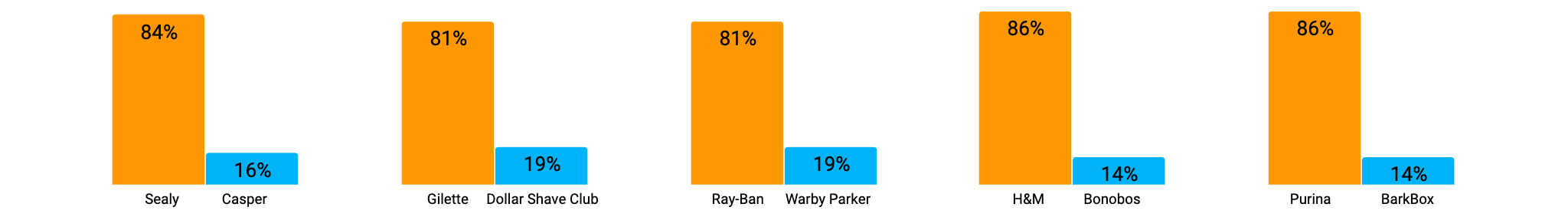

Which brand do you have more loyalty to?

Sealy – 84%

Casper – 16%

Gillette – 81%

DSC – 19%

RayBan – 81%

Warby Parker – 19%

H&M – 86%

Bonobos – 14%

Purina – 86%

Barkbox – 14%

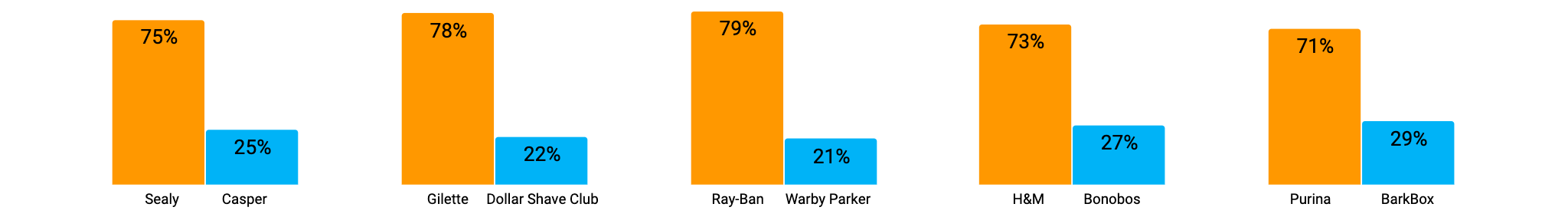

Which brand would you most likely not mind spending extra money for?

Sealy – 75%

Casper – 25%

Gillette – 78%

DSC – 22%

Ray-Ban – 79%

Warby Parker – 21%

H&M – 73%

Bonobos – 27%

Purina – 71%

BarkBox – 29%

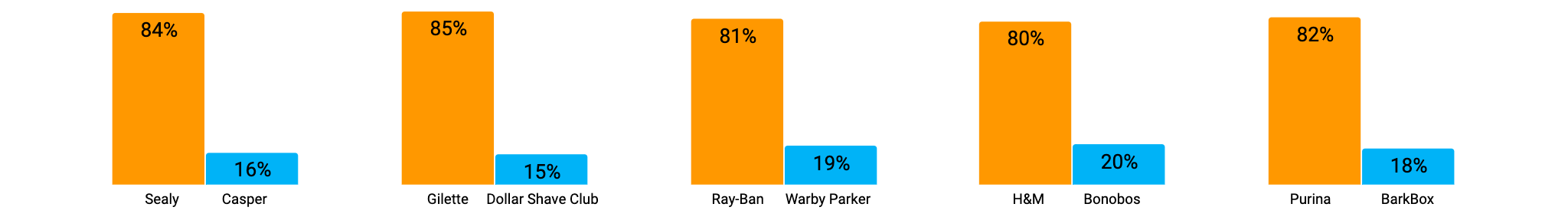

Which brand do you trust more?

Sealy – 84%

Casper – 16%

Gillette – 85%

DSC – 15%

Ray-Ban – 81%

Warby Parker – 19%

H&M – 80%

Bonobos – 20%

Purina – 82%

BarkBox – 18%

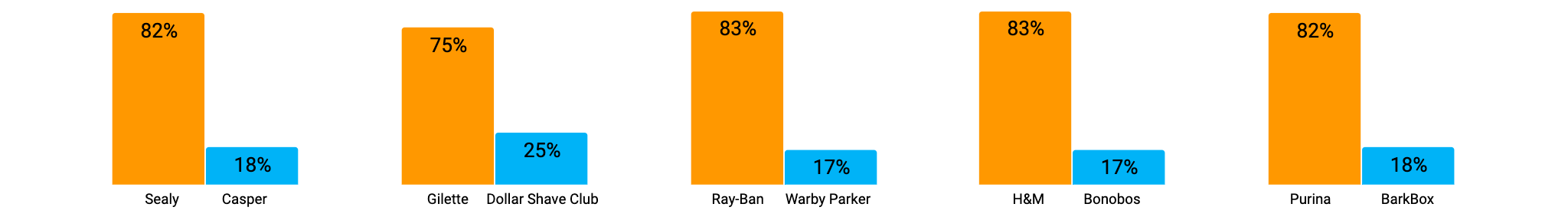

Which brand do you think you have a greater understanding of what it represents?

Sealy – 82%

Casper – 18%

Gillette – 75%

DSC – 25%

Ray-Ban – 83%

Warby Parker – 17%

H&M – 83%

Bonobos – 17%

Purina – 82%

BarkBox – 18%

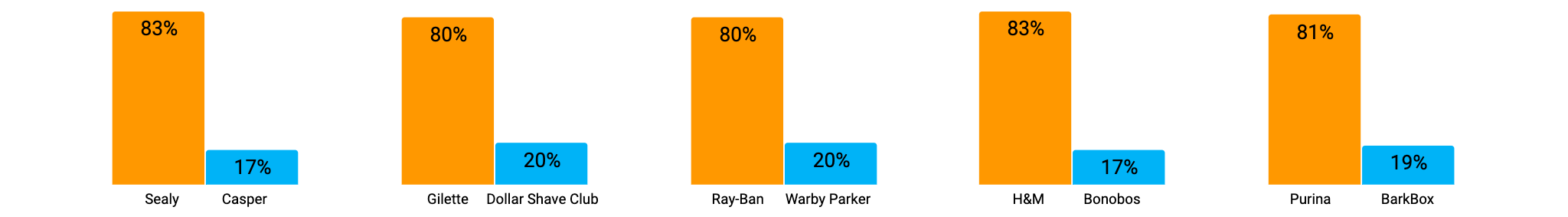

Which brand would you feel more comfortable recommending to your friends and family?

Sealy – 83%

Casper 17%

Gillette – 80%

DSC – 20%

Ray-Ban – 80%

Warby Parker – 20%

H&M – 83%

Bonobos – 17%

Purina – 81%

BarkBox 19%

“Our study demonstrates that advertising strategies that are geared toward brand building are still very important for creating long-lasting relationships with consumers, even in a direct-to-consumer world. As many popular DTC brands gained significant market traction, some marketers started to question the effectiveness of digital brand advertising, reconsidering ad spend on brand building versus direct-response strategies,” said Chris Kelly, founder and CEO of Upwave. “However, I think that the marketing industry learned the wrong things from the DTC revolution. It’s not that brand advertising is less important; it’s instead more important

than ever. As production capabilities, distribution channels, and advertising access have all been democratized and opened to new entrants, the only thing that distinguishes a company is its brand.”

The study results did reveal a bright spot for the DTC brands. The youngest group tested (18-24) was consistently more likely to favor the DTC brand across most categories. Some of the DTC brands, like Casper, have recently started investing more heavily in brand advertising, targeting younger consumers especially.

Some of the notable DTC-favoring findings among younger consumers included:

- Casper: Casper performed better in brand consideration (question #2) among the 18-24 group compared to Sealy (45% for Casper; 55% for Sealy)

- DSC: Dollar Shave Club performed better in brand consideration (question #2) among the 18-24 group compared to Gillette (49% for DSC; 51% for Gillette)

- DSC: Dollar Shave Club performed better in brand understanding (question #6) among the 18-24 group (48% for DSC; 52% for Gillette)

- Bonobos: Bonobos performed better in brand consideration (question #2) in both the 18-24 group (43% for Bonobos; 57% for H&M) and the 25-34 age group (48% for Bonobos; 52% for H&M)

- BarkBox: BarkBox performed better in brand recommendation (question #7) among the 18-24 age group (40% for BarkBox; 60% for Purina).

All respondents were screened for familiarity with the brands, frequent online shoppers and had in fact recently purchased the type of product(s) offered by the brand pairs. The Upwve study was conducted in September and October 2019.